As a leader in South Africa’s solar energy market, Alumo Energy is revolutionising how homes and businesses become more energy efficient. By partnering with Gathr, Alumo has streamlined its credit assessment and onboarding processes, allowing for faster, more precise financial vetting. This case study explores their collaboration with Gathr, highlighting credit check requirements, integration specifics, and the successes achieved so far.

Alumo Energy’s Mission

At Alumo Energy, innovation is at the heart of everything they do. Their mission is simple: deliver cutting-edge solar energy systems that are reliable, cost-effective, and designed to meet both individual and business needs. Alumo’s people-first approach prioritizes long-term partnerships, ensuring customer satisfaction, employee pride, and high-quality service.

With expertise spanning electrical, engineering, construction, and finance, Alumo provides comprehensive solar solutions – from design to installation and maintenance. Their 280+ staff across six branches are committed to delivering energy independence and sustainability to every customer.

What Alumo needed?

In the solar energy sector, understanding a customer’s financial health is critical for both the provider and the customer. Whether it’s a business or homeowner, misjudging financial stability could lead to missed opportunities or strained financial circumstances.

One of Alumo’s biggest challenges was accessing accurate credit information quickly during the application process. This delay impacted the customer journey and prolonged onboarding.

Enter Gathr

Alumo turned to Gathr to overcome this challenge. Gathr’s seamless API integration with credit bureaus provided Alumo with fast, reliable, and affordable access to consumer and business credit scores. By enabling automated credit checks, Alumo could now offer three tailored financial packages:

- Own It: Outright purchase of the solar system.

- Rent It: A flexible rental option with a pathway to ownership.

- Month-to-Month Rental: The most affordable, short-term solution.

Each option requires precise financial assessments, which Gathr’s solution streamlined, ensuring that customers were matched with the right payment plan.

Why Gathr?

Alumo Energy partnered with Gathr for several key reasons:

- Faster Decision-Making: Gathr’s API integration drastically reduced the time required to access vital financial data, allowing Alumo to vet customers in seconds.

- Cost-Efficient Solution: Gathr’s services provided significant cost savings compared to other providers, all while maintaining data accuracy.

- Customisable Credit Vetting: Gathr’s flexible solution allowed Alumo to build a tailored credit vetting process, perfectly suited to their business model.

Solution

Gathr delivered a fully integrated credit bureau solution tailored to Alumo Energy’s specific needs. With the API, Alumo can access both detailed and summary credit reports, enabling faster onboarding and more informed decision-making. This integration also paves the way for future enhancements, such as bank statement analysis to further improve credit assessments.

How our solution works for their platform – by simply entering an individual’s name and South African ID number, you can instantly check their credit status, gaining insight into their financial health. This feature not only simplifies the evaluation process but also strengthens security, helping you verify an applicant’s ability to afford your products or services. It effectively reduces risk and ensures that your onboarding decisions are backed by comprehensive financial data, increasing the reliability of your process.

Integration

The partnership with Gathr has been marked by efficiency and continuous improvement. Since the initial integration, Alumo has benefited from regular updates and enhancements based on feedback loops with the Gathr team.

“The integration was seamless. Gathr’s team guided us every step of the way.”

– Gerhard Scheffer, Finance Manager, Alumo Energy

Outcome

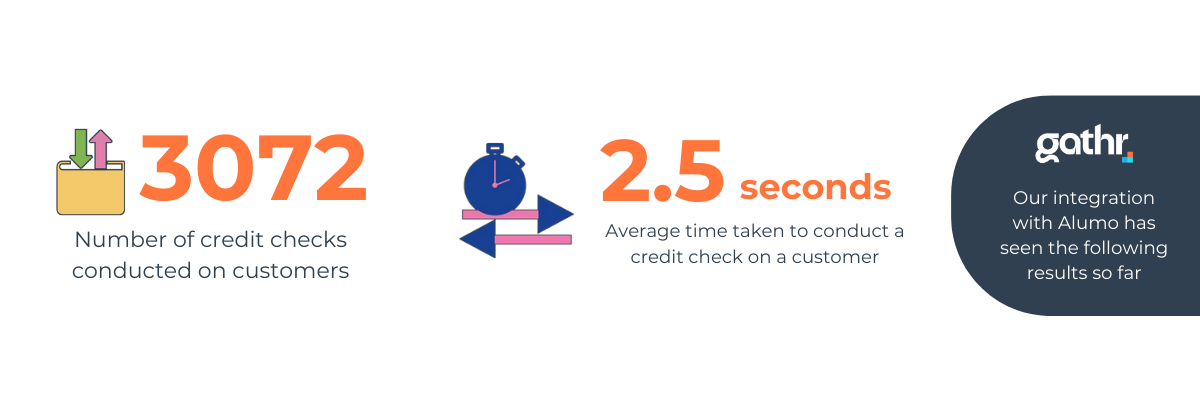

The collaboration has yielded remarkable results:

- Faster Turnaround: What used to be a manual, time-intensive process has become largely automated, with initial credit checks completed in under 5 seconds.

- Improved Customer Experience: Alumo now delivers faster responses to customers, reducing friction and creating a smoother onboarding experience.

The Road Ahead for Alumo Energy

With rising electricity costs and the growing demand for renewable energy, Alumo Energy is poised for continued growth. They aim to become South Africa’s most trusted solar brand, renowned for quality, customer service, and innovation.

By partnering with Gathr, Alumo has strengthened its technological foundation, ensuring they remain at the forefront of the solar industry. This collaboration is a testament to how fintech solutions like Gathr can drive operational efficiency and improve the customer journey, paving the way for a more sustainable and financially secure future.