Our engineering team has enhanced our affordability module by introducing a new feature that provides an additional method for collecting bank statements. Users can now send their bank statements directly to a dedicated email address. Once the email is received, we parse the bank statement to extract the account and transactional data, giving our clients access to the necessary information to complete an affordability assessment. This product update ensures our affordability module offers a wide range of collection options, ensuring no customer is excluded from the onboarding experience.

How Does Email Bank Statement Collection Work?

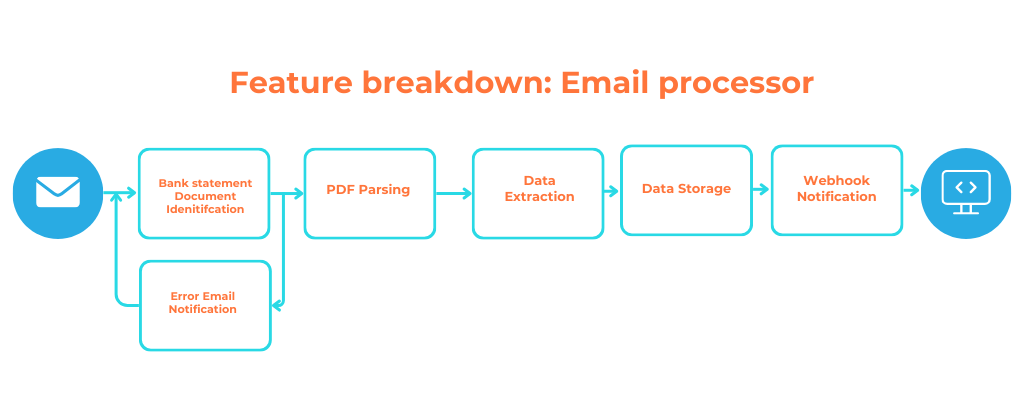

This enhancement simplifies and optimises our affordability module’s bank statement collection process. By leveraging our email processor, here’s how it works:

- Customers send their bank statements to a designated email address.

- Gathr manages both the customer association and the bank statement parsing.

- Our platform processes the statements automatically, extracting account and transaction data.

- The extracted data is then uploaded to the customer profile created on the Gathr platform.

- Once this is complete, a webhook notification is sent to the client (the customer will receive an email saying the bank statements were processed successfully). Clients can then retrieve the data from Gathr’s platform, allowing seamless integration via Gathr’s API.

Benefits for Users

- Faster processing: Customers can send their bank statements via email while waiting in line, allowing the affordability assessment to be completed almost instantly.

- Direct information transfer: Data goes straight to the decision-making source, speeding up the process.

- No additional apps or platforms: Customers only need access to an email address – no need for QR codes or extra applications.

Benefits for Our Clients

- No email creation needed from the client’s side: the tenant doesn’t need to create a designated email address, and they won’t need to manage it. This will be managed on our side, and the data will be retrieved from Gathr’s platform.

- Time savings for agents: Agents receive documentation before even sitting at their desks, allowing them to make lending decisions faster. This shifts the responsibility of providing information from the agent to the customer.

- In-branch efficiency: The entire process – from sending bank statements to receiving them and conducting an affordability assessment – can be completed within a branch. This reduces the likelihood of clients leaving to seek alternative lenders.

- Simplified integrations: With fewer touchpoints needed to retrieve transactional statements, integration becomes more streamlined.