Over the last couple of weeks our team have been working on further optimising our Gathr processes and solutions. We’ve made a number of significant developments thanks to the help of our operations manager, software engineers and test engineers.

Here’s an overview of some of these optimisations:

- Library extension – expanding our archive of statements accepted.

- New features: 1. Upfront bank account validation 2. Accepting broader range of prefixes

- Transaction processing optimisation

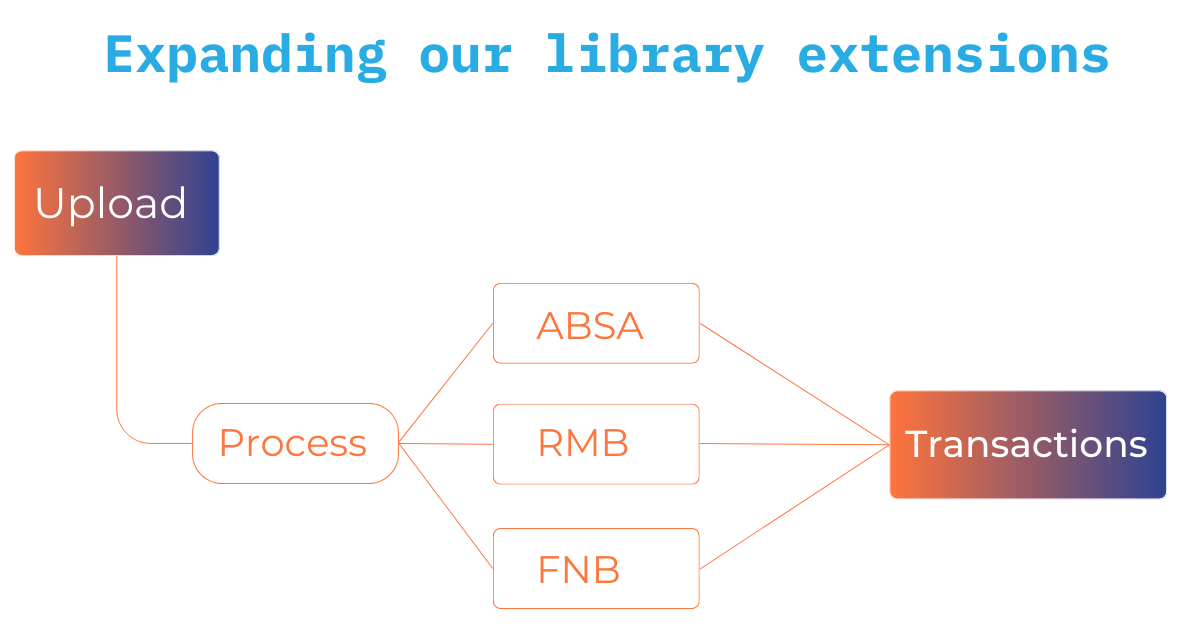

Expanding our library extensions

In a nutshell what this means is that we have greater room for processing capabilities. With our expanding portfolio we are now able to process more statement template types, and we are able to use these as transaction, address or bank account ownership proof.

How this works?

If for example a customer were to make use of our consumer affordability module they might have previously come across an error whilst uploading their bank statement. This error would’ve been because a user had uploaded a Standard Bank transaction history statement instead of their monthly bank statement. With our new library extension this error will no longer occur, and the user can continue the upload journey and the client can easily process an application.

Transaction history statements, we are now able to process:

- Standard Bank

- Nedbank

- FNB (coming soon)

Bank statements, we are now able to process:

- RMB Private Wealth

Different language types:

- FNB Afrikaans bank statements

- ABSA Afrikaans bank statements

New features geared towards mitigating fraud

Upfront bank account validation

This new feature is a fantastic addition for our clients, it means that our clients can now mitigate fraud right at the beginning of an application process. A new process flow will look something like this: User will provide their statement to an agent; the agent will then proceed to make use of our solution to validate the bank account owner and bank account number. Matching the application information against the supporting statement, ensuring that the applicant is the rightful owner of the account.

Accepting a broader range of prefixes

Part of our mission for this product release was adding features that could further mitigate fraud or errors for our clients. To do this we have added a broader range of prefixes e.g. Dr, Prof etc, this way when we validate an account the user’s details match those on an application.

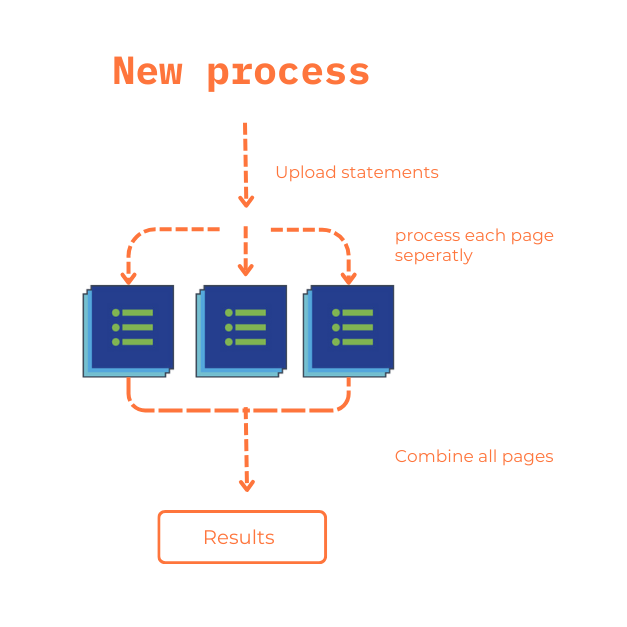

Revving up the speed on processing transactions

Over the last year our team have been laser-focused on optimisation. This month we can put a number to it, in the past to process 3000 transactions it took us 90 seconds, this month the same process only takes us 23 seconds.

How did we get to this point?

Our tech team have been focused on processing transactions asynchronously, by using a more logical approach.

Here’s an analogy from our ops manager to help you along the way:

“If we want to make 100 sandwiches more effectively, we don’t hire 100 people to make the sandwiches because then it becomes too difficult to scale. Instead, we think of ways this process can be done more effectively, by looking at opportunities to perform tasks concurrently, this way getting it done faster, more efficiently and with fewer people.”

We’ve applied this same theory to optimising our infrastructure, and that’s why our solutions are more seamless than ever.