We’re more than halfway through the year, and we’re keeping the momentum going. August has been all about enhancing our offerings and expanding capabilities for your success. Our latest Gathr product release was focused on fine-tuning our KYB API to now include comprehensive business account verification, making the onboarding process even more seamless.

We’ve also teamed up with a trusted bureau to offer seamless access to verified CIPC information and expanded our business bank statement library to include additional banks – ensuring broader coverage.

We sat down with our Head of Operations Kirsten Hancock to chat about or latest releases to better understand the progress we’ve made.

Business Account Verification

We’ve enhanced our KYB API service to now include comprehensive business account verification, streamlining the onboarding process for companies. Similarly to our consumer account verification solution, this is focused on

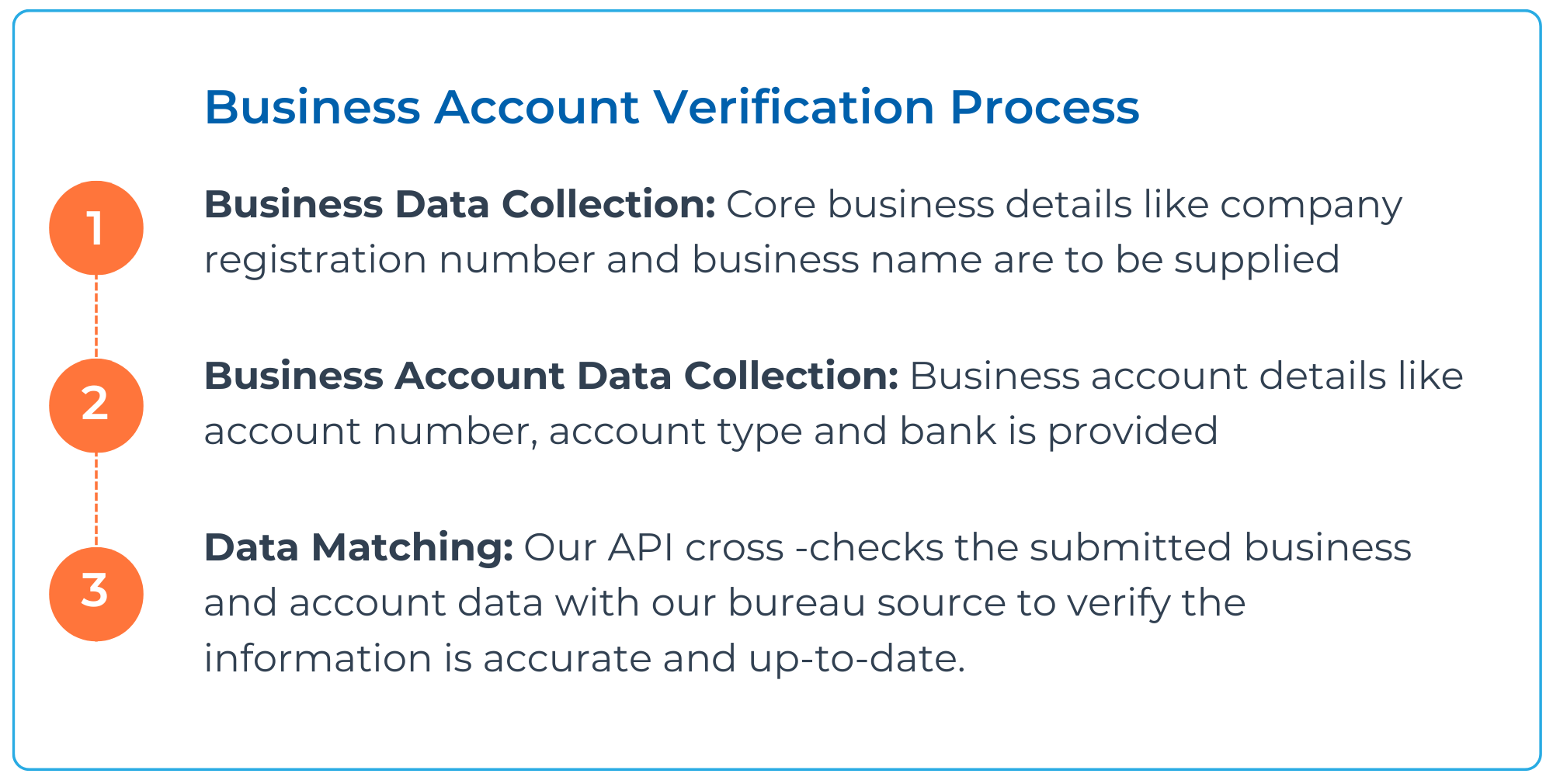

How does Business Account Verification work?

How does it improve our KYB offering?

By automating and integrating bureau data, the verification process becomes faster and more accurate, enabling quicker onboarding for businesses. Additionally, cross-referencing with a trusted bureau enhances fraud prevention, adding a critical layer of security that makes it more difficult for fraudulent businesses to pass verification.

What challenges does this solution solve?

- Streamlining the onboarding process: Automated direct integration simplifies verification, significantly reducing the time and effort needed to onboard new clients.

- Reducing operational costs: By minimising manual intervention, direct integration lowers the operational costs associated with verification and onboarding.

- Enhancing data accuracy and reliability: Pulling directly from a reliable, up-to-date data source ensures that the information used is current and accurate.

- Reducing fraud: Cross-referencing and verifying data with a trusted source decreases the risk of fraud.

Which businesses would use this feature?

Businesses handling high transaction volumes, requiring regulatory compliance, and needing to mitigate risks related to fraud and financial instability will greatly benefit from the enhanced Business Account Verification process. This applies to financial institutions, payment processors, B2B service providers, and any business that must verify the legitimacy of its partners, clients, or vendors.

Key beneficiaries include:

- Financial institutions (banks, fintechs, and lenders)

- Payment processors and payment gateway providers

- Marketplaces and e-commerce platforms

- Telecom companies and utility providers

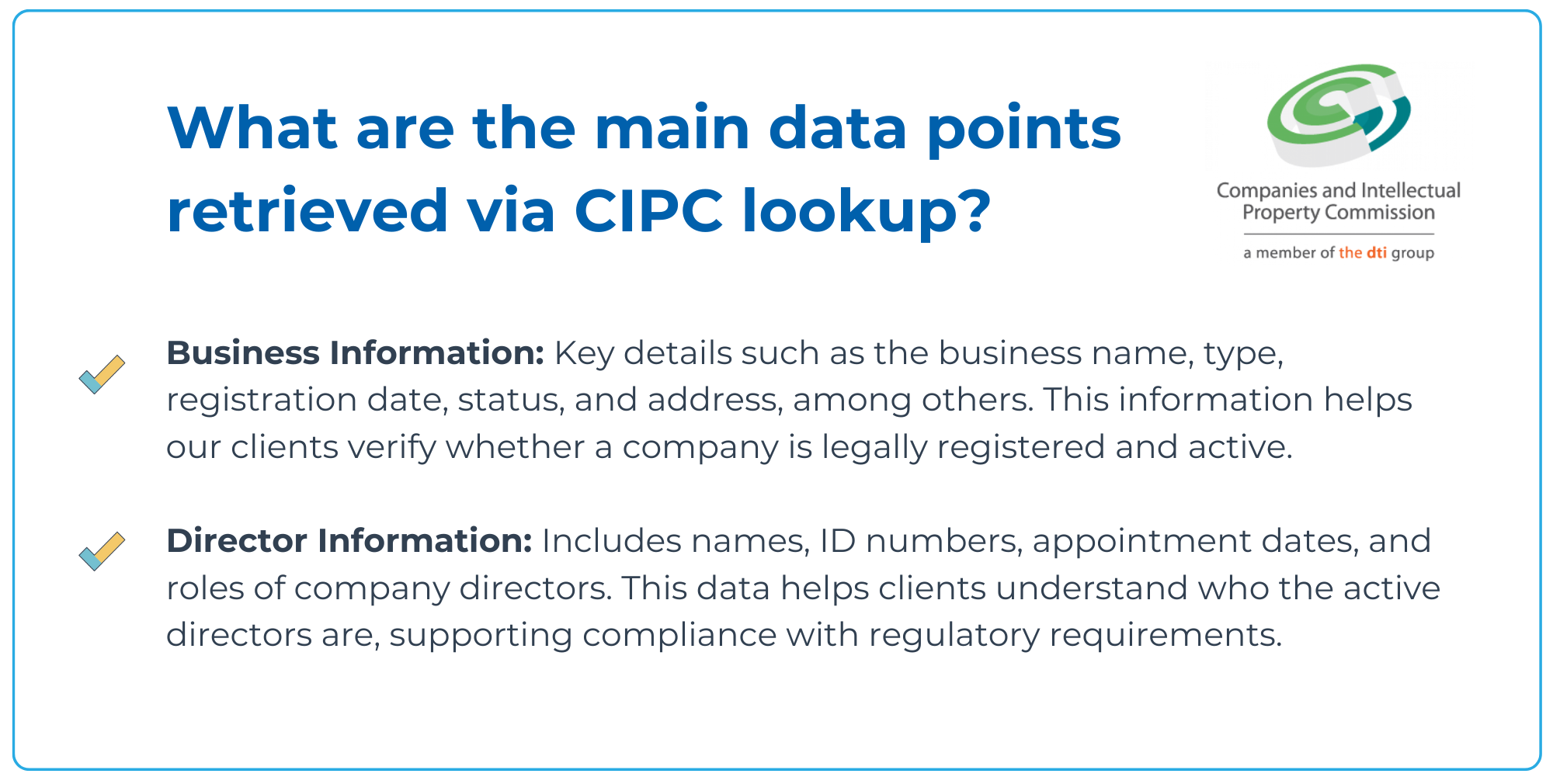

CIPC LookUp Integration

We’ve partnered with a trusted bureau to offer seamless access to business and director information using company registration numbers. This integration allows direct access to all CIPC data with a single input, eliminating the need to manually gather information from multiple sources. Clients can now retrieve comprehensive business and director details in real-time, streamlining the process and enhancing efficiency.

What are the benefits of this feature?

- Data Accessibility: The integration allows clients easy access to CIPC data, enabling more informed decision-making and helping them avoid potential legal or financial penalties.

- Real-Time Verification: Clients gain real-time access to the latest business and director information, allowing for swift verification of legal status and directorship.

- Improved Auditing: With access to authoritative CIPC data, clients can maintain accurate records of verification activities, ensuring strong audit trails and compliance.

Expanded Business Bank Statement Support

Our business bank statement library now includes statements from RMB and Capitec, enhancing access to essential business transactional data for more comprehensive financial insights. This is an ongoing initiative, and our team will continually expand the library to offer broader and more diverse business statement data coverage.

How did we decide which banks to include in this expansion?

Client Demand: We focused on adding banks that are frequently requested by our clients, ensuring the expanded library addresses the practical needs of businesses relying on our services for affordability assessments.

Market Coverage: Our goal is to include a wide range of banks to provide comprehensive market coverage.