If you’re in the business of working with businesses, this one is for you. Onboarding a business isn’t as simple as verifying a single entity – there are layers of data to uncover. You have the director or business owner, and then you have the enterprise itself. To onboard either effectively, you need to ensure they are legitimate, financially stable, and compliant with regulations.

We’ve revamped our KYB (Know Your Business) solutions with expanded features and enhanced data sources to provide a seamless, intelligent, and comprehensive verification process. The goal? To ensure you’re working with real, honest, and non-sanctioned partners, service providers, and customers.

Traditionally, businesses face multiple challenges when conducting legal entity checks, including:

- Long processing times that slow down onboarding

- Decreased conversion rates due to inefficient verification workflows

- Lack of comprehensive data leading to gaps in due diligence

- Manual document verification, which increases risk and workload

- Complex enterprise data integrations, making automation difficult

- Regulatory compliance hurdles that add operational complexity

Gathr has tackled these issues head-on by developing a powerful KYB solution that eliminates friction, improves data accuracy, and enhances the user experience. Whether you’re onboarding directors or enterprises, our cutting-edge technology ensures fast, secure, and fully compliant verification processes.

KYB solutions for Directors vs Enterprises

Not all business verification is created equal. While directors need personal identity and financial history checks, enterprises require deeper financial assessments and ownership validation. Let’s break it down.

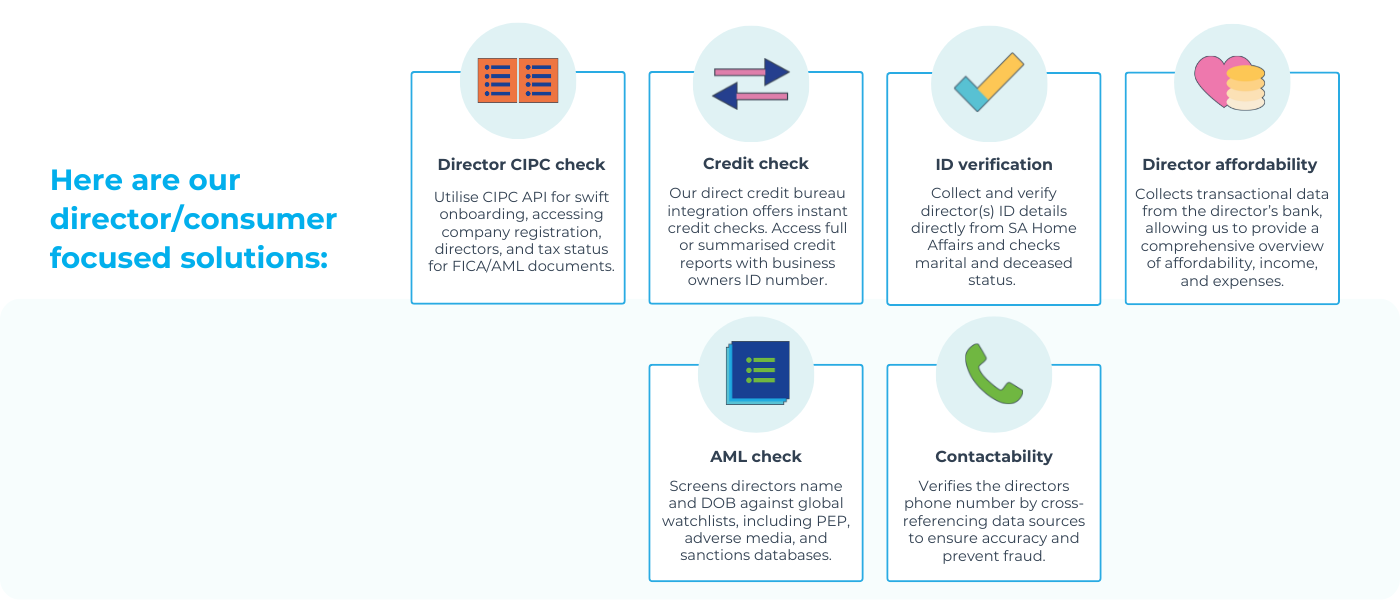

Onboarding a director

A director is the face of a business, but are they financially stable? Are they legally compliant? Our structured KYB process ensures companies work with legitimate, creditworthy leaders. Here’s how:

- Director CIPC Check: Instantly retrieves directorship status, tax compliance, and company affiliations.

- ID Verification: Confirms identity using South African Home Affairs (HANIS) data, including marital and deceased status.

- Credit Check: Real-time credit bureau integration provides a full financial profile, flagging risks before they become liabilities.

- AML Screening: Screens against global and local watchlists, including PEP, adverse media, and sanctions databases.

- Phone Number Verification: Cross-references data sources to ensure accuracy and prevent fraud.

- Affordability Assessment: Extracts and analyses bank statement data to assess financial stability.

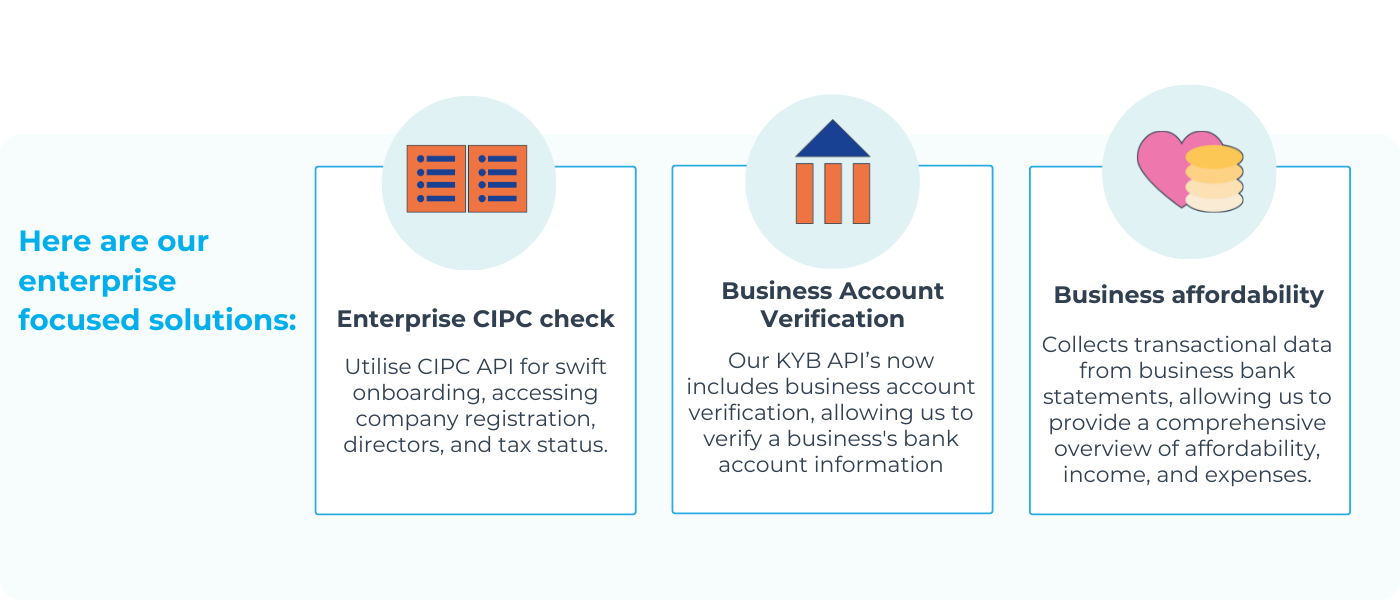

Onboarding an enterprise

When dealing with businesses, the stakes are higher. Is the company financially sound? Do its banking details match its official records? Can it afford to do business? Gathr streamlines the verification process:

- Enterprise CIPC Check: validates business registration, directors, and tax status in seconds.

- Business Account Verification: ensures the business bank account is legitimately linked to the registered company.

- Business Affordability Check: analyses financial health by extracting transactional data from bank statements.

- Credit Bureau Integration: Retrieves business credit reports for a transparent financial history.

- Fraud Prevention Measures: Flags high-risk entities using AI-driven risk detection with transactional categorisation and bank statement data checks.

How Gathr’s KYB solutions work

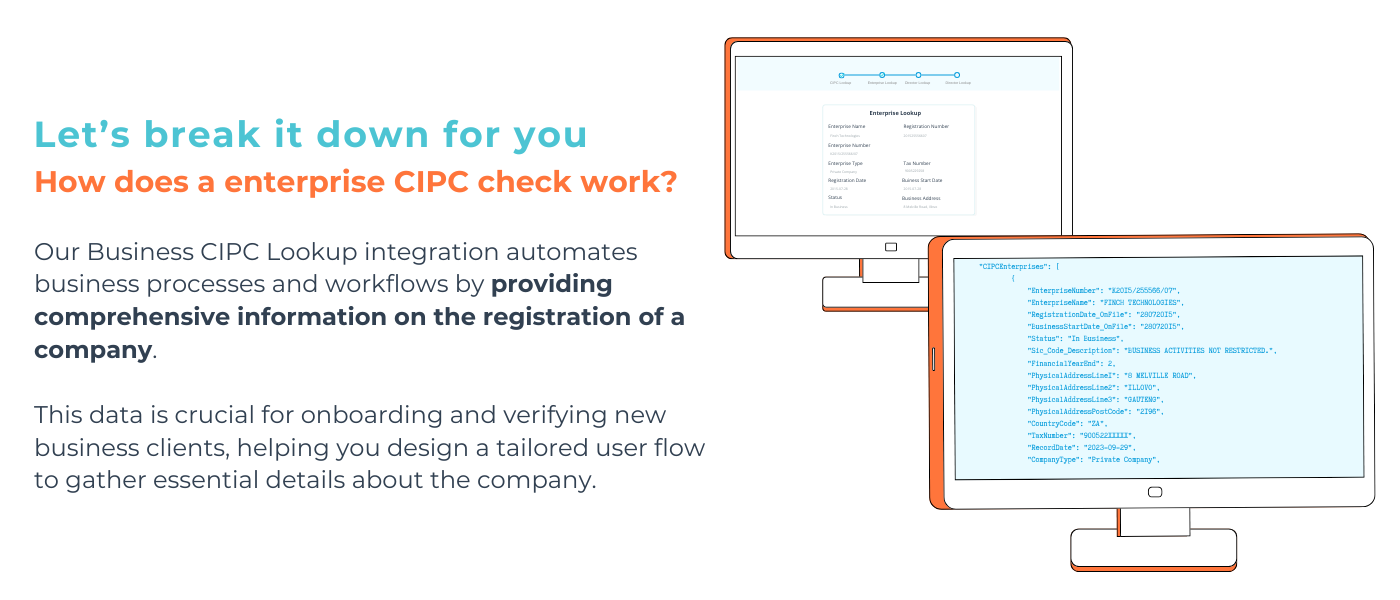

Enterprise CIPC Check

Retrieve enterprise CIPC information with the input of a business registration number. By automating access to company registration details, businesses can reduce manual errors and eliminate onboarding friction. This not only speeds up processes but also ensures compliance with regulatory bodies.

Business Bank Account Verification

Using the name and ID number, and registered account details we can verify business bank account ownership. Fraudulent banking information can lead to financial losses. Our system confirms legitimate business ownership, ensuring all transactions are secure and properly attributed.

Business Affordability Check

By collecting 3 months of bank statements, our solution can get a better understanding of a business’s financial position. Our affordability check provides a 360-degree financial view, detecting red flags that might otherwise go unnoticed.

Director CIPC Check

Using a company registration number we automate director verification, we eliminate the risk of dealing with fraudulent or financially unstable individuals.

Credit Check for Business Owners

Using just an ID number, we can determine a director’s credit health. Our real-time integration with credit bureaus helps organisations assess financial risks before making commitments.

Director/Business Owner ID Verification

Fraudsters love loopholes. By cross-referencing ID data with Home Affairs, we shut them down before they start an application or customer onboarding journey.

Director Affordability Check

We extract, verify, and analyse bank statement data to paint a clear picture of financial health, helping companies make faster, smarter onboarding decisions.

Phone Number Verification

Invalid or mismatched contact details can signal fraud. Our real-time verification ensures accuracy by using a customer’s ID number to verify contact details – reducing risk and improving communication.

Automated AML Checks

Using our solution, you’ll be able to screen customers against global watchlists with high accuracy and efficiency. Our API endpoint compiles detailed reports on identified matches, highlighting risks and recommended actions.

How does this API integration work?

No more complicated workflows. Our plug-and-play API integrates seamlessly, offering a frictionless onboarding experience. With multiple bank statement collection methods – including Online Login, Statement Upload, USSD, and Email – businesses can onboard clients however they choose.

Why companies choose Gathr’s KYB solutions

- Eliminates manual errors: Automation ensures 100% accuracy, reducing costly human mistakes.

- Cuts costs & saves time: Streamlining verification means businesses can onboard clients faster and cheaper.

- Enhances security & compliance: Stay ahead of AML, KYC, and FICA regulations without the extra work.

- Boosts operational efficiency: Real-time checks accelerate approvals, enabling businesses to move at the speed of opportunity.

- Detects & prevents fraud: AI-driven risk detection flags potential threats before they become problems.

Our roadmap: the future of KYB solutions

Business verification shouldn’t be tedious – it should be intelligent, intuitive, and impactful. With Gathr’s advanced KYB solutions, companies can onboard faster, smarter, and safer – without sacrificing compliance or security.

The days of manual verifications, endless paperwork, and reactive fraud detection are over. Gathr is paving the way for seamless, automated, and intelligent KYB processes.