As digital banking and lending solutions become more prevalent in South Africa, there has been a noticeable increase in fraud. While this surge poses significant challenges for traditional banks, it also opens up substantial opportunities for fintechs to play a key role in combating these threats. This article delves into the rise of digital fraud, its effects on fraud and default rates, and the proactive steps both banks and fintechs are taking to tackle these issues.

The Rising Tide of Digital Fraud

Digital fraud has become a significant threat to the financial sector globally, and South Africa is no exception. A 2023 report from the South African Banking Risk Information Centre (SABRIC) reveals that digital fraud incidents have surged by 30% over the past two years. This increase reflects the growing sophistication of cybercriminals who exploit vulnerabilities in digital lending platforms through various fraudulent techniques.

Key types of fraud impacting the industry include:

- Phishing Attacks: Fraudsters use deceptive emails or messages to trick individuals into revealing sensitive information such as passwords or financial details. According to SABRIC, phishing attacks have increased by 25% over the past year.

- Identity Theft: Criminals steal personal information to apply for loans under false pretenses. Reports indicate that identity theft cases have grown by 35%, highlighting the urgent need for enhanced verification processes.

Fraud and Default Rates

The financial impact of fraud is profound, affecting both fraud and default rates within the lending industry. In 2022, South African banks reported losses exceeding R2 billion due to digital fraud, a sharp increase from R1.5 billion in 2021. This significant rise underscores the growing threat posed by fraudsters and the need for effective mitigation strategies.

Fraudulent activities impact default rates, as loans granted based on false information often result in repayment issues – that’s why fraud mitigation tools are essential for any lender.

The National Credit Regulator (NCR) has reported a 15% increase in default rates associated with loans suspected of involving fraudulent activities. This rise in defaults not only affects the profitability of lenders but also impacts their ability to provide credit to legitimate borrowers.

Strategies to mitigate fraud

South African banks are implementing a range of strategies to combat fraud and protect their digital platforms. These measures include:

1. Biometric Verification: Banks are increasingly adopting biometric authentication methods such as fingerprint and facial recognition to verify borrowers’ identities. This approach reduces the risk of identity theft and ensures that loans are granted to genuine applicants. A recent survey revealed that 60% of South African banks have integrated biometric verification into their systems.

2. AI and Machine Learning: The use of AI and machine learning is becoming widespread in fraud detection. These technologies analyze vast amounts of data to identify patterns and anomalies indicative of fraudulent activity. According to industry reports, AI and machine learning solutions have improved fraud detection accuracy by 50% over the past year.

3. Multi-Factor Authentication (MFA): MFA requires customers to provide multiple forms of identification before accessing their accounts. This additional layer of security makes it more challenging for fraudsters to gain unauthorized access. A recent study found that 70% of South African banks have implemented MFA as a standard security measure.

4. Enhanced Monitoring and Analytics: Banks are investing in advanced monitoring systems that track transactions and identify unusual behavior. Continuous monitoring and sophisticated analytics help detect and prevent fraud in real-time. Data indicates that enhanced monitoring systems have led to a 20% reduction in successful fraud attempts.

Different Types of Fraud in South Africa

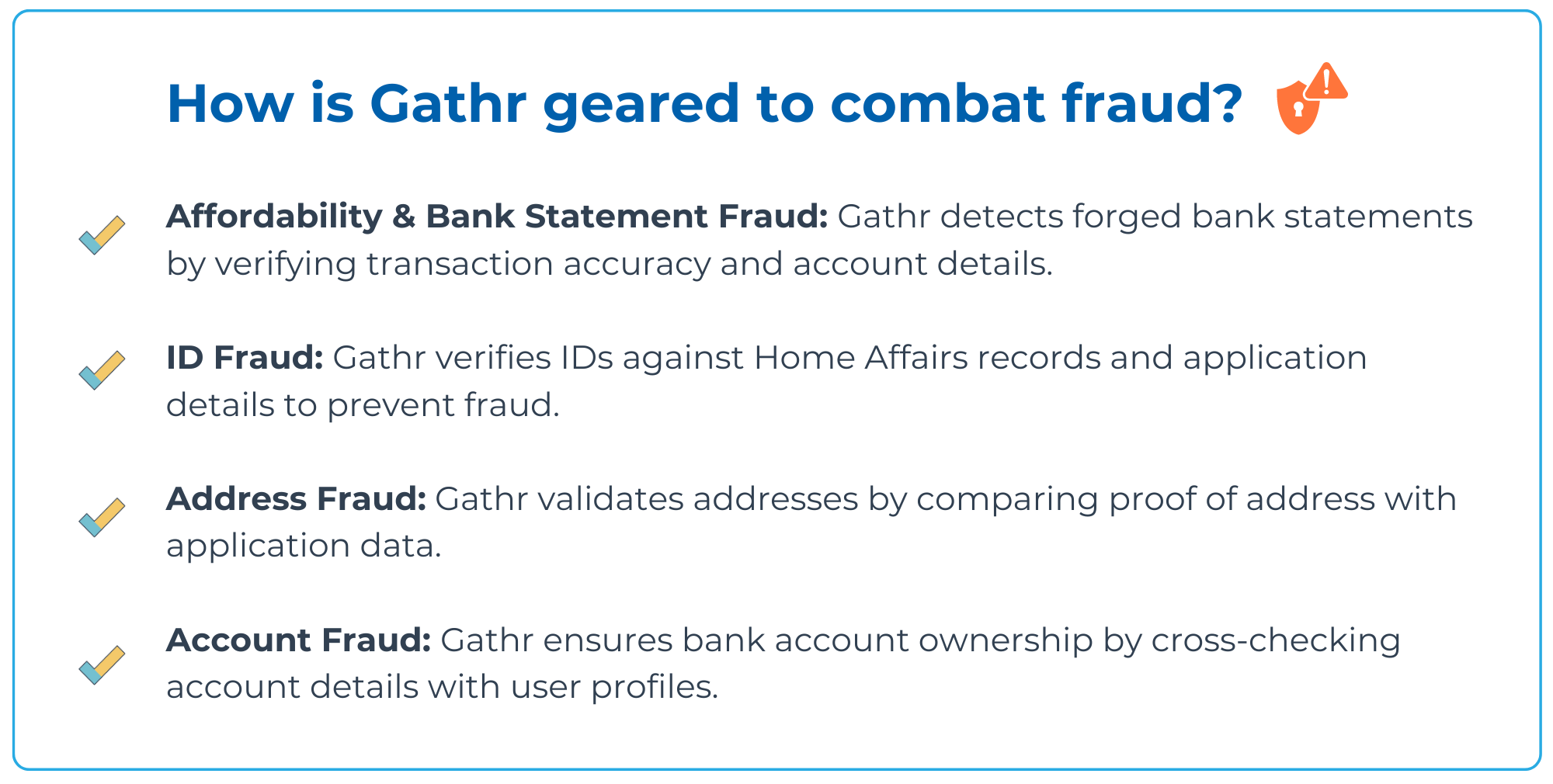

Here are different types of fraud and how Gathr‘s solutions can help mitigate them:

1. Bank Statement Fraud

Fraudsters often forge bank statements to falsely represent their financial status and qualify for loans or products they can’t afford. Our fraud check feature in the affordability solution detects discrepancies by analysing bank balances, metadata, and QR codes.

2. ID Fraud

The use of stolen or fake IDs to apply for financial products is a significant issue, leading to substantial financial losses. Our ID verification solution cross-references ID numbers with Home Affairs records to verify their authenticity, including checking for deceased statuses. Additionally, our ID validation tool swiftly compares ID document details against customer applications.

3. Address Fraud

Fraudsters sometimes use fraudulent addresses to apply for financial products, impacting credit profiles and causing problems for the rightful address owners. Gathr’s address validation solution enables lenders to upload proof of address and validate it against the user’s profile, ensuring accuracy by comparing the document address with application data.

4. Account Fraud

Using someone else’s bank account for financial transactions can lead to payment defaults and complications for both lenders and consumers. Gathr’s account verification tool confirms the applicant’s legitimacy by cross-checking bank account details against user information and ensuring the account has been active for more than three months.

*It’s crucial to conduct these checks in tandem, as relying on a single method won’t provide complete fraud coverage. Combining these checks offers a more robust approach to mitigating fraud.

Leading Fintechs in Fraud Mitigation

Several South African fintech companies are at the forefront of developing innovative solutions to mitigate fraud in the lending industry. These fintechs are leveraging technology to address various types of fraud:

1. Gathr (obviously we’re biased but if you’ve read the above you’ll know why): Gathr offers a comprehensive suite of fraud prevention solutions, including ID verification, bank statement fraud checks, and KYC solutions. Their technology examines bank balances and metadata to detect fraudulent transactions, and cross-checks IDs and addresses against official records.

2. ThisIsMe: ThisIsMe provides an extensive range of identity verification and KYC solutions. Their platform uses biometric and data verification technologies to confirm borrowers’ identities, significantly reducing the risk of identity fraud. Their solution has achieved a 95% accuracy rate in identity verification.

3. Curata (Powered by Comcorp): Curata focuses on real-time biometric facial recognition matching against South Africa’s national population register. Their solution helps combat fraud and ensures consumer consent, achieving a 100% compliance rate.

4. Orca Fraud: Orca Fraud offers a no-code solution for effective fraud mitigation. Their platform provides tools to prevent fraud and protect businesses, making it easier for lenders to integrate fraud prevention measures into their operations.

The impact of fraud on the South African lending industry is substantial, with rising fraud rates and increasing default risks posing significant challenges. As digital fraud continues to evolve, it is crucial for banks and fintech companies to stay ahead of emerging threats through innovative technologies and robust security measures. The collaborative efforts of traditional banks and fintech pioneers in developing advanced fraud prevention solutions are vital to safeguarding the industry and maintaining public trust.

By leveraging biometric verification, AI, machine learning, and advanced analytics, the lending industry can strengthen its defenses against fraud. The contributions of leading fintech companies play a crucial role in enhancing security and shaping a resilient financial ecosystem in South Africa. Addressing different types of fraud – such as affordability, ID, address, and account fraud – requires a comprehensive approach, and ongoing advancements in fraud prevention technologies will be key to achieving long-term success in combating these challenges.

—-

Stay tuned for our full lending & fraud report 👀 launching soon.