Over the past few months, our team has been building something exciting to help lenders better understand their customers’ likelihood to repay. By analysing everyday banking transactions, our new propensity-to-pay model delivers a clear, near-term view of repayment risk – putting powerful repayment insights directly into lenders’ hands.

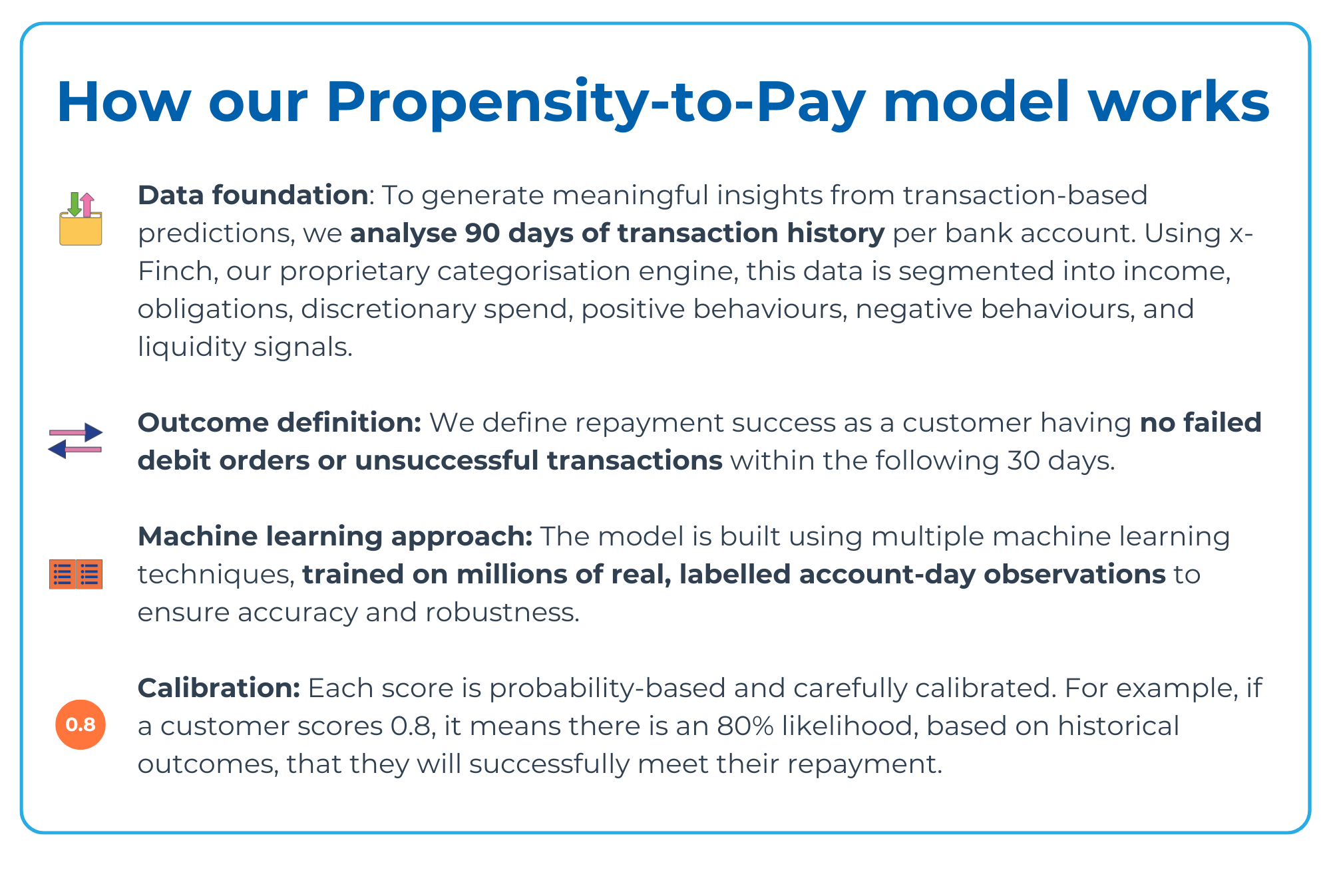

The three-second overview: we’ve built a predictive engine that takes 90 days of transactional history and transforms it into a repayment score. This score shows how likely a customer is to miss an obligation payment within the next 60 days, giving lenders a forward-looking tool for faster, smarter decisions.

Why should this matter to lenders?

Traditional credit scores rely heavily on bureau data and static profiles. By contrast, our approach turns raw transaction data into a dynamic, actionable score of each customer’s repayment likelihood.

Advantages of Transaction-Based Predictions

- Freshness: Measures behaviour as it happens, not months later. For example: a salary change, a recent missed payment, or a shift in spending.

- Breadth: Works for customers with thin or no credit files. Payment history isn’t required; all non-payment behaviours are tracked.

- Granularity: Detects liquidity stress (missed debit orders, negative balances, gambling spikes) invisible to bureau data.

- Actionability: Lenders can adapt treatment strategies in real time. Our continuously trained model also allows for configurable parameters and risk settings.

How can lenders use the score?

Underwriting

- Segment applicants by repayment likelihood: approve, decline, or adjust pricing/limits.

- Support responsible lending by identifying at-risk customers before extending new credit.

Portfolio Management

- Monitor repayment likelihood across the existing book.

- Detect rising stress early and adjust exposure accordingly.

Collections & Recoveries

- Prioritise outreach to high-risk accounts.

- Tailor engagement methods (SMS, call, restructure) based on predicted risk level.

Operational Efficiency

- Align debit-order dates with customer cashflow.

- Reduce failed debit fees while improving customer experience.

Why collaboration from lenders is important?

Our model already demonstrates strong predictive power, but it gets even better when combined with lenders’ own repayment data, product nuances, and operational insights. By partnering with us, lenders can:

- Improve predictive accuracy across loan types.

- Tailor features to portfolio-specific needs (e.g. retail credit vs. secured lending).

- Co-develop scorecards that reflect unique risk appetites.

We’re actively inviting lenders to collaborate with us, refining and deploying this model to ensure it not only predicts risk but also integrates seamlessly into day-to-day lending decisions. If you’d like to find out more about how this will work, book a meeting with any of our team members, and we’ll walk you through it. Our free report provides a summary overview of what this score could look like for you.