MPOWA stands as a pioneer among South Africa’s online micro-lenders, renowned for prioritising the customer experience. Their commitment lies in delivering a smooth and efficient loan-seeking experience within the digital realm. This case study offers an in-depth look at MPOWA’s strategic collaboration with Gathr, shedding light on their affordability assessment requirements, the Gathr solution, integration specifics, and what we’ve achieved so far.

What is MPOWA’s mission?

With over 16.7 million employed South Africans navigating various economic pressures, the demand for personal finance solutions is significant. MPOWA’s mission is to extend a helping hand to those earning above R10 000 per month, offering accessible short-term financial assistance. As an innovative FinTech, MPOWA has been at the forefront since its establishment in 2008, pioneering online short-term lending in South Africa. Central to their success is their dedication to leveraging technology to address intricate challenges. MPOWA Finance continually refines and enhances its products to enhance customer satisfaction. What sets MPOWA apart from their competitors is their commitment to financial inclusion, utilising alternative data for comprehensive affordability assessments. For instance, when assessing a customer’s eligibility for a R5000 loan, MPOWA looks at six months of data rather than just three, ensuring a more accurate reflection of their financial status. Their team constantly updates calculations based on customer data to inform risk models, thus enhancing decision-making processes. This approach translates to better rates for customers and increased likelihood of future funding due to the comprehensive understanding of their financial behaviour.

What MPOWA needed?

In the micro-lending space, accurate affordability assessments are essential, offering both the lender and the consumer a clear understanding of financial stability and preventing undue financial strain. A critical challenge in online applications lies in obtaining up-to-date bank statements as proof of income, with the absence of this feature leaving a higher risk of fraudulent activities. Gathr stepped in to address this issue by validating the authenticity of bank statements uploaded by applicants.

Why Gathr?

In the pursuit of combating fraud and streamlining the retrieval of transactional data for affordability assessments, MPOWA found Gathr to be the perfect ally. Their decision to partner with Gathr was driven by specific objectives:

- Fraud Reduction: By verifying documents and data, Gathr aids in reducing bank statement fraud.

- Seamless Transaction Data Retrieval: MPOWA sought an integration-friendly system that could effortlessly retrieve transactional data.

- Affordability and Efficiency: Gathr provides a swift, cost-effective, and user-friendly solution, enhancing MPOWA’s affordability assessment capabilities.

Solution

Gathr delivered MPOWA a comprehensive solution perfectly aligned with their requirements. The integration involved Gathr’s consumer affordability functionality which allows bank statement collection and reading. Our trusted API solution seamlessly integrated into MPOWA’s platform to assist them with the lending decision-making process.

Here’s how it works: When a potential borrower initiates the lending process with MPOWA, with specified requirements and consent, the integration of Gathr’s consumer affordability tool enables clients to retrieve transactional data from their bank statements. This retrieval can occur through one of three methods:

- Online Login: Accessing the customer’s bank statement directly.

- Statement Upload: Uploading the customer’s bank statements.

- USSD: Retrieving bank statements via a USSD process on a mobile phone.

Through this process, authentic bank statement data is obtained to assess the client’s financial status. MPOWA can then utilise this data to make informed lending decisions and provide customers with clear guidance on their affordability.

Integration

The partnership between MPOWA and Gathr has been swift and efficient. Since the initial integration, MPOWA’s system has seen significant enhancements and continues to evolve through an ongoing feedback loop with our team.

“Our system has improved greatly since initial integration and continues to improve through a feedback loop with Gathr. We have a very positive outlook going forward with this partnership.” Matthew Knowlden, COO at MPOWA FINANCE

Outcome

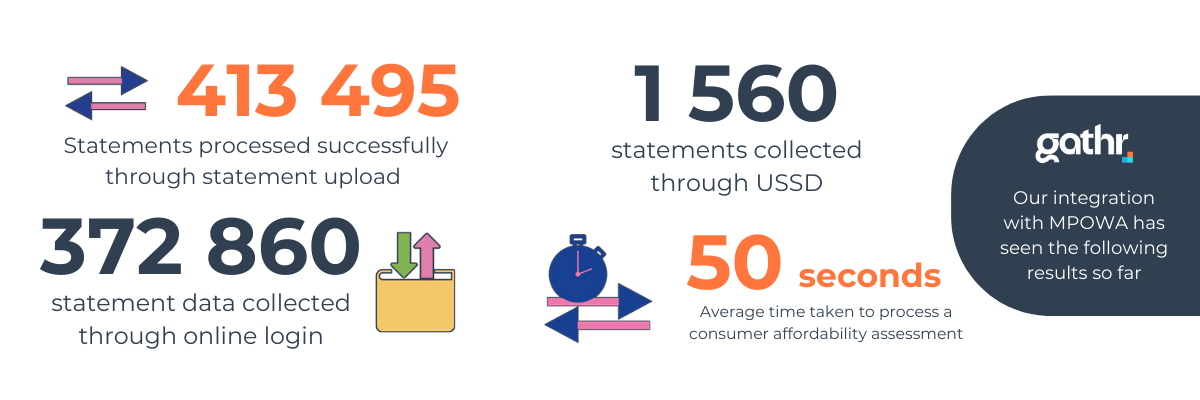

The collaboration between MPOWA and Gathr yielded positive outcomes:

- Streamlined automation: The transition to Gathr facilitated smooth uploading and verification of client bank statements. Automated transaction identification bolstered efficiency, combating fraud and minimising manual involvement. Consequently, significant cost savings were achieved through reduced call center agent phone time.

- Facilitating financial access: Expanding the reach of financial products to a broader audience through enhanced onboarding and loan application processes.

What does the future hold for MPOWA?

MPOWA is dedicated to dominating the micro-lending sector in South Africa with its innovative platform, continually enhancing the client experience and application process. With Gathr as a trusted ally, they are primed for ongoing expansion and innovation within the lending industry. A key focus of this optimisation is reducing the “drop off” rate experienced by clients during the bank statement retrieval process, and we look forward to assisting them with this goal.

This strategic partnership exemplifies how harmonious collaboration among fintech entities can lead to the creation of platforms better suited to serve the end user—the South African consumer.