Our latest release enhances bank statement processing by introducing an advanced, behind-the-scenes safeguard that ensures operational continuity. While the standard statement parsing process remains unchanged, an AI-driven fallback mechanism has been integrated to assume control should statement template changes or other disruptions occur.

For existing clients, this enhancement is delivered seamlessly as part of the affordability module. It requires no activation, or configuration. Instead, it functions silently in the background to maintain processing consistency.

This update significantly reduces the likelihood of failures, safeguards against interruptions, and guarantees that statement parsing continues reliably across varying templates. As a result, clients benefit from stronger business continuity, improved processing success rates, and higher overall conversion outcomes, all without additional effort.

Why should it matter to you?

Banks update their statement formats without warning, which traditionally leads to processing failures and costly interruptions. With AIDA, your operations stay live and uninterrupted, ensuring business continuity regardless of format shifts.

What are some of the key benefits for our clients:

- No more downtime or failures: Operations keep running even when formats change.

- Greater accuracy: AIDA delivers 94% precision, reducing errors and avoiding false rejections from minor typos.

- Higher conversions: Faster onboarding, fewer drop-offs, and smoother approvals mean more customers successfully onboarded.

- Future-ready resilience: This release lays the foundation for features like AI-powered auto-generation of templates, blending traditional speed with AI adaptability.

How it works

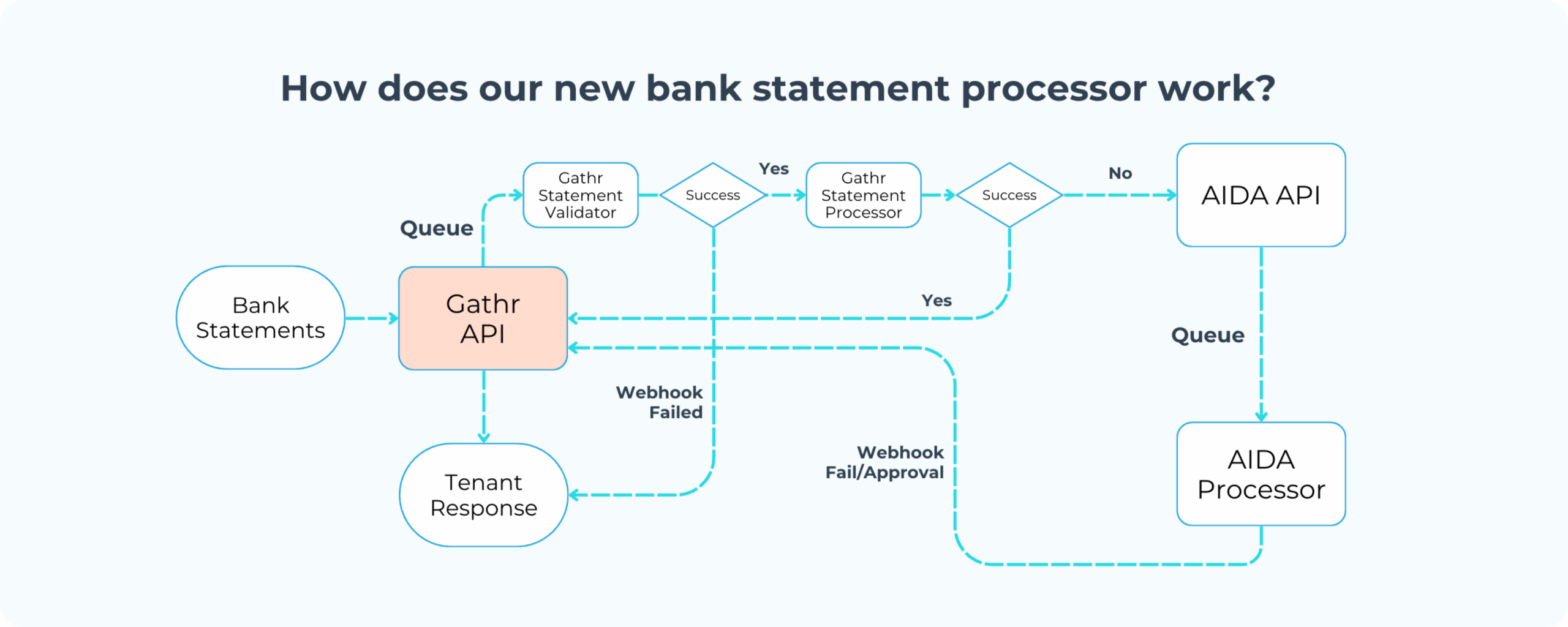

The new process validates each statement and applies the standard bank template when possible. If a template fails, the system automatically switches to AIDA’s AI-powered fallback, which extracts financial details and returns a structured summary. This ensures accurate, usable data is always delivered, without disruption.

On average, AIDA processes a bank statement in 30 seconds to one minute, keeping workflows efficient and responsive. Fraud detection is also built in at the earliest stage, preventing fraudulent documents from consuming resources.

Other questions you might need answered on this new release:

How does billing work when AIDA succeeds or fails?

Billing is based on the terms of your contract, and no additional charges will be incurred for using AIDA instead of the Gathr parser.

When is the document tampering check performed?

Our document tampering check (fraud detection) happens at the beginning of the journey during the statement processor step. This prevents fraudulent statements from consuming additional resources or reaching AIDA, saving valuable time.

What does the future of this update look like?

This update is more than just a reliability improvement. It opens the door to:

- Expansion into new markets by supporting more banks across countries.

- Payslip processing, extending capabilities into payroll documentation (stay tuned for this product launch).

- Scalable adoption, ensuring flexibility no matter the bank or statement type