We’re always looking for ways to enhance our solutions and bring an even more sophisticated offering to companies. Our new Affordability Reports are designed to provide businesses with a more detailed breakdown of income and expense categories. These refinements deliver a clearer, more accurate financial picture, helping companies make more informed decisions with confidence.

Affordability Reports unpacked

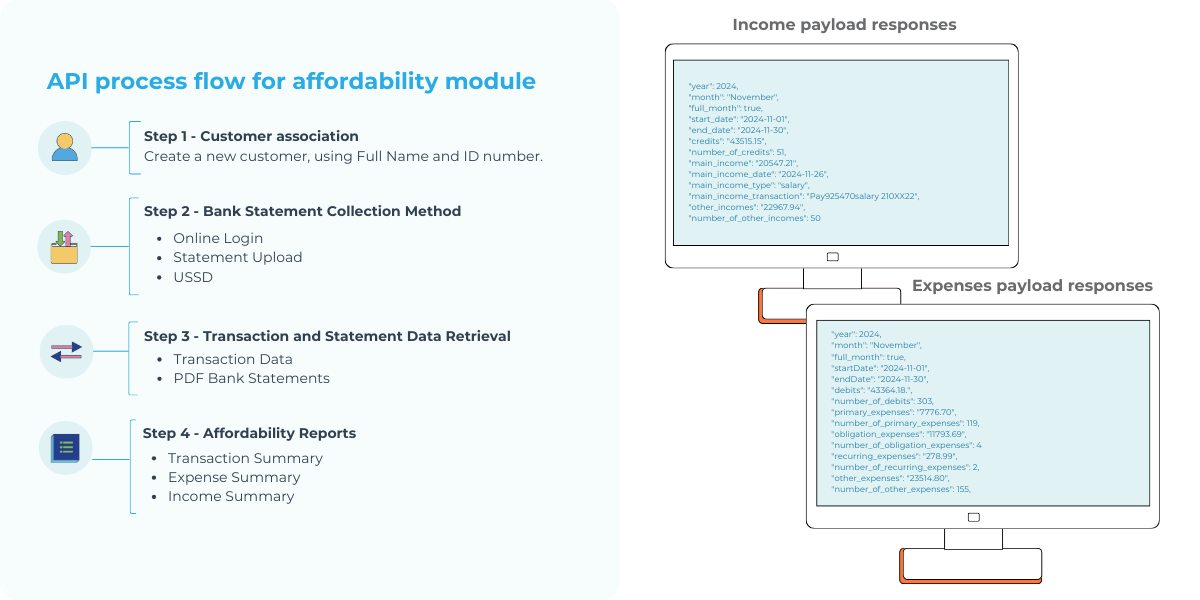

Our improved Affordability Reports offer a more structured and insightful approach to assessing financial data. Companies can leverage these enhancements to:

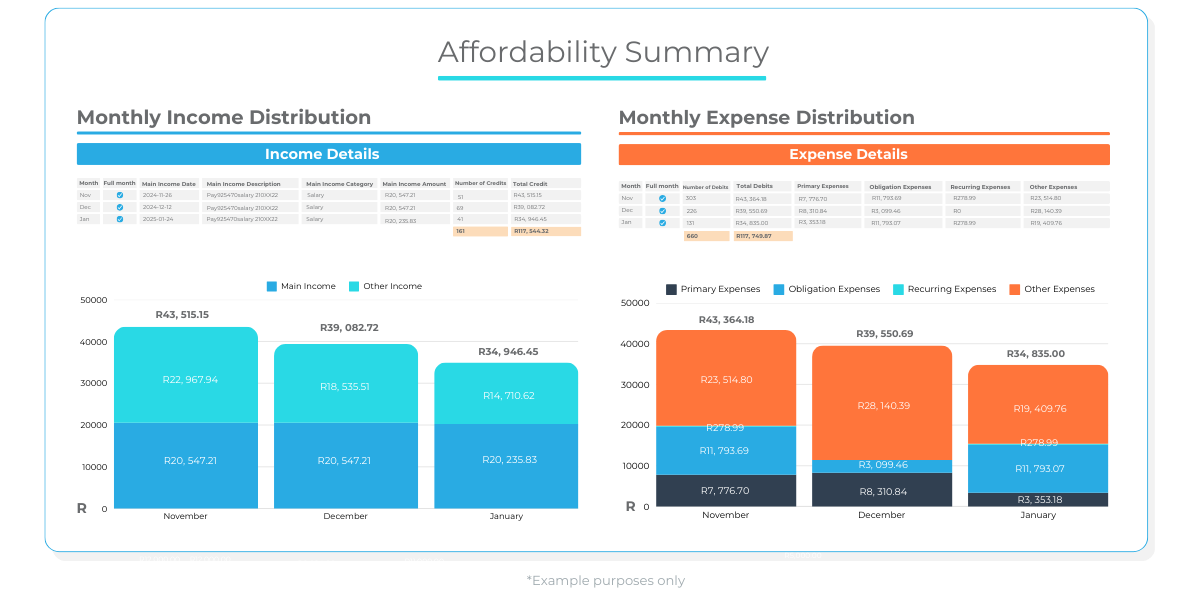

- Gain deeper affordability insights: identify key financial indicators such as main income, primary expenses and debt obligations.

- Integrate seamlessly with our API: easily incorporate these insights into your existing systems to refine your financial evaluations.

How can businesses use these enhancements?

Businesses can leverage these enhancements to optimise financial decision-making, improve risk assessments, and personalise financial products. Here’s how and why they would use this categorised transaction data:

1. Enhanced affordability assessments

By accessing a structured summary of incomes and expenses, businesses – especially lenders, insurers, and fintech platforms – can conduct affordability checks with greater accuracy. They can:

- Determine stable vs. irregular income sources to assess borrowing capacity.

- Identify discretionary vs. necessary spending to gauge financial resilience.

- Assess debt obligations to ensure responsible lending and mitigate default risks.

2. Smarter credit and loan decisioning

Financial institutions can use the categorised data to:

- Automate credit risk evaluations based on spending behaviour rather than just credit scores.

- Set dynamic lending thresholds based on real financial health.

- Identify customers with good financial habits who might not have traditional credit histories.

We’ve restructured our classification system to give businesses more granularity in assessing affordability. Our API docs unpack these different income and expense categories in a lot more depth.

These updates empower businesses to make smarter, data-driven affordability assessments while providing a more accurate reflection of customers’ finances.

Get started by integrating our enhanced Affordability Reports into your workflows and unlock deeper financial insights for better decision-making.